The Tight Float Phenomenon at Nasdaq:SMX How Ownership Structure, Not Share Count, Defines Market Power

Jeremy Frommer

Published on December 4, 2025

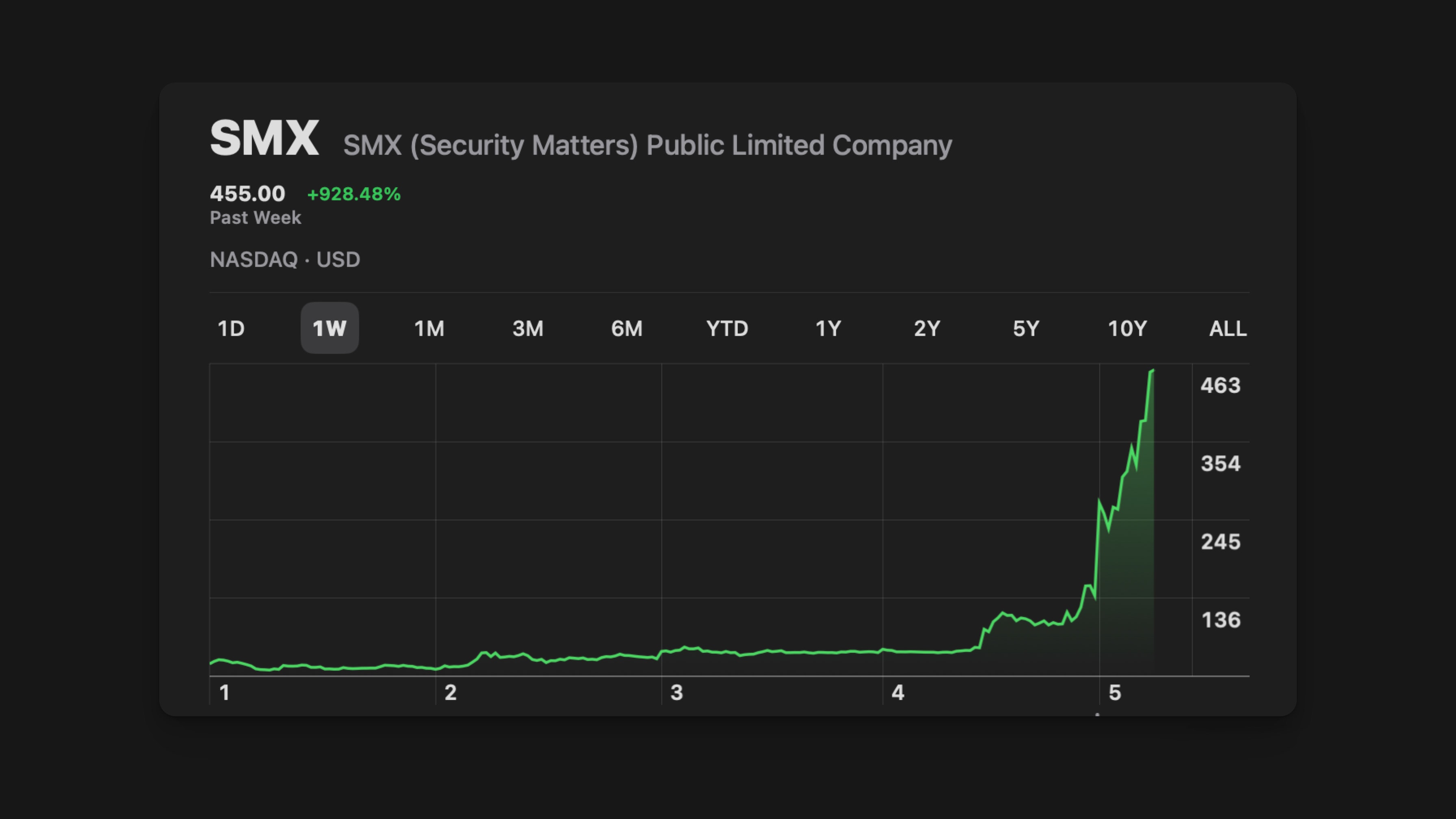

NASDAQ-listed SMX (Security Matters PLC) has demonstrated the power of float architecture in real time, trading from $3 to a high of $490 not because of hype, but because of structural tightness, disciplined ownership, and the market’s complete misread of available liquidity.

This behavior offers a tactical blueprint for the entire microcap space — a roadmap for CEOs on how to build cap-table discipline, neutralize predatory algos, and turn float structure into a competitive advantage the market cannot easily counter.

There are certain ideas in public markets that get repeated so often, they stop meaning anything. “Tight float” is one of them. The term has become a kind of shorthand, a lazy label traders apply whenever a stock moves more violently than they expect or fails to respond to their usual tactics. But if you’ve actually lived inside these markets — if you’ve been on trading desks, managed risk, run companies, survived multiple cycles — you know that tight floats have almost nothing to do with what most people think is happening.

A tight float isn’t about the number of shares outstanding.

It isn’t about the number of shares in the float.

It isn’t even about how many shares insiders own.

A float becomes tight because of behavior — not arithmetic.

It becomes tight because of who owns the shares, why they own them, how they behave during stress, and how much of the float is psychologically unavailable to the market.

You can have 2 million shares available and trade loosely.

You can have 20 million shares available and trade tighter than a drum.

Mathematically identical floats can behave in opposite ways depending entirely on ownership discipline.

The misconception is simple: people want to believe floats are defined by numbers because numbers are easy. But float behavior is defined by structure, and structure is created by people.

And when a float is structured correctly — when ownership is concentrated, conviction is strong, and supply is locked — it becomes a pressure system the market cannot easily control. It becomes hostile to short sellers. It becomes an environment where small bursts of demand lead to disproportionate price discovery. It becomes a reminder that fundamentals matter, but structure decides the speed at which fundamentals are recognized.

This article is about that structure — the tight float phenomenon, how it forms, how it behaves, how to identify it, and why CEOs who understand it can use it as a strategic advantage without ever crossing a line.

The Market Misunderstands Tight Floats Because It Wants Simple Answers

Every day, traders scan for low floats. It’s the simplest filter in the world:

Find me any stock with under X million shares in the float.

But this is a crude shortcut that captures nothing meaningful.

A low float is not the same thing as a tight float.

A low float is a number.

A tight float is a condition.

A low float tells you nothing about behavior. For all you know, those shares are owned by short-term traders who panic on the first downtick. That stock will trade loose, sloppy, and easily influenced.

A tight float tells you that supply is unavailable at current prices, even if the share count makes it appear otherwise.

In other words:

Tight floats are behavioral, not mathematical.

This distinction is obvious to anyone who’s managed risk in real size. It’s not obvious to people who evaluate a float the way they evaluate a weather report — by looking at one number.

How to Recognize a Tight Float

If you want to understand whether a float is tight, ignore the share count and watch how the stock trades:

Do small orders move the stock disproportionally?

Do spreads widen even when volume is moderate?

Does the stock gap on little or no news?

Do market makers pull their quotes quickly?

Does buying pressure escalate sharply?

Does selling dry up even under aggressive pressure?

Do obvious shakeouts fail because holders refuse to sell?

Is borrow availability inconsistent or nonexistent?

Those are the signs of a structurally tight float.

The market is telling you there is a supply vacuum — not because the shares don’t exist, but because the shareholders aren’t offering them.

Ownership discipline creates scarcity.

Scarcity forces inefficiency.

Inefficiency creates volatility.

Volatility becomes opportunity.

This is float structure in its purest form.

Tight Floats Form When the Weak Hands Are Gone

Microcaps especially are environments where tight floats form naturally, but not because of their size. They form because the companies that survive are often the ones that have been through every form of financial adversity imaginable:

Toxic lenders

Derivative overhang

Predatory financings

Lawsuits

Delayed filings

Unstable auditors

Delisting threats

Market maker manipulation

Short-selling campaigns

Liquidity deserts

When a company finally stabilizes after years of this, something unusual happens:

The shareholder base becomes hardened.

The weak hands have already sold.

The tourists have left.

The day traders have moved on.

The low-conviction holders tapped out years ago.

What remains are shareholders who held through the worst possible environment. Their cost basis is stable. Their conviction is high. Their psychology is not reactive. These shareholders do not sell because they’ve already lived through bigger declines than whatever the current market is showing them.

This is how tight floats form organically.

Not through hype, but through survival.

Concentration Is the Core Mechanism of a Tight Float

The single largest factor in tight float behavior is concentration. When a handful of shareholders — sometimes three, five, maybe ten — hold a majority of the float, the market’s ability to extract liquidity collapses.

People think liquidity is created by share count. It’s not. Liquidity is created by willingness to sell.

If the holders are disciplined, coordinated in philosophy (not collusion — just alignment), and long-term oriented, the float is effectively locked.

This is where price becomes hyper-sensitive.

This is where market makers get uncomfortable.

This is where short sellers miscalculate.

This is where volatility becomes asymmetric.

A concentrated float is not just tight — it is unresponsive.

In a loose float, pressure produces supply.

In a tight float, pressure produces nothing.

This is how short squeezes begin — not because someone “pumps” a stock, but because supply refuses to behave the way the market expects it to.

Case Study: SMX and the Modern Tight-Float Blueprint

If you want a clean example of structural tight-float behavior in today’s market, look at SMX.

After implementing a 75:1 reverse split to meet NASDAQ listing requirements, the assumption from traders and algorithms was simple:

“Now there will be liquidity.”

But real market structure is never that simple.

What actually happened is that ownership became even more concentrated.

Legacy holders who believed in the business remained.

New supply didn’t rush in.

The float that appeared mathematically accessible became behaviorally locked.

SMX began trading like a textbook tight float:

Small orders moved the tape disproportionately

Borrow availability was inconsistent

Spreads widened easily

Price discovery became nonlinear

Short sellers assumed liquidity that didn’t exist

And perhaps the most instructive point of all:

SMX created the ability to finance itself through an ATM or an ELOC — but did not draw on it.

This is a structural signal.

Most microcaps, when they secure an ATM or ELOC, use it reflexively and destructively. They treat it like a fire hose they can’t wait to turn on. Supply floods the market. Holders get diluted. Shorts get ammunition.

SMX did the opposite.

They secured optionality but exercised restraint.

They gained access to capital but refused to inject supply.

They deployed structure instead of liquidity.

That choice matters.

That choice preserves tightness.

That choice tells experienced market participants: “The cap table is not your playground.”

The result is a float that behaves like a far smaller one — not because of its share count, but because of its psychology and architecture.

When a CEO Understands Float Structure, Everything Changes

This is the part most CEOs never learn, and it’s one of the biggest advantages in microcaps:

A CEO cannot control the stock price, but a CEO can shape the float.

A CEO who understands the mechanics of float structure can:

Clean the cap table

Remove toxic instruments

Consolidate long-term shareholders

Attract strategic investors

Reduce artificial supply

Increase alignment

Control issuance

Maintain discipline with ATMs and ELOCs

Avoid unnecessary dilution

Create an environment where natural demand dictates price discovery

This is not about manipulation.

This is about structural engineering.

When a CEO structures a float correctly, something unusual happens:

Short sellers enter the position thinking they are trading a normal float.

They are not.

They are entering a pressure chamber.

Not because the CEO is “squeezing” them — that’s not how real markets work — but because the absence of supply is a form of pressure.

Short sellers depend on liquidity.

Tight floats remove liquidity.

This is not emotional torture — it is structural torture.

A short seller who is wrong in a liquid stock gets out at a loss.

A short seller who is wrong in a tight float gets trapped.

The distinction is enormous.

It’s the difference between a trade and a crisis.

Why Tight Floats Will Dominate the Next Microcap Cycle

We are entering a unique period in U.S. capital markets:

Liquidity is fragmented

Algorithms drive the majority of order flow

Market makers warehouse less risk

Retail behavior is unstable

Short sellers are more aggressive

Microcaps are deeply undervalued

Traditional research coverage has vanished

Surviving companies are structurally cleaner

In that environment, the companies that survive — the ones that execute, deleverage, build real businesses, and maintain disciplined floats — will experience extreme mispricings followed by violent re-ratings.

The next cycle will not be slow.

It will not be incremental.

It will not be orderly.

It will be structural.

And companies with tight floats will lead it, not because they are “promotional,” but because the market is structurally incapable of containing a float that is both tight and backed by improving fundamentals.

This is why CEOs must understand float structure.

This is why shareholder alignment matters.

This is why cap-table engineering is not administrative — it is strategic.

A tight float is not a meme concept.

It is not a “squeeze play.”

It is not a gimmick.

It is the most powerful structural advantage available to a well-run microcap.

For CEOs: How to Build a Tight Float Without Crossing a Line

A tight float must form naturally. It cannot be forced or manufactured. But it can be engineered with legitimacy and discipline.

Here is what that looks like:

1. Clean Up the Balance Sheet

Reduce liabilities, eliminate predatory notes, fix auditor issues, and restore trust.

2. Consolidate the Cap Table

Bring in long-term holders, strategic investors, and insiders who share conviction.

3. Remove Artificial Supply

Avoid unnecessary dilution, minimize ATM usage, and exercise restraint with ELOCs.

4. Execute Operationally

Fundamentals eventually matter — especially when structure accelerates recognition.

5. Communicate Transparently

A disciplined shareholder base forms when communication is consistent and honest.

6. Avoid Hype

Floats tighten because of structure and trust, not marketing campaigns.

7. Respect the Market

The market is not an enemy. It is a reflection of structure.

Build the float the right way and the market will eventually recognize the business.

The Core Truth

A tight float is not defined by scarcity.

It is defined by control, discipline, and behavior.

The float is not a number.

It is a network of shareholders.

It is a collective posture.

It is a structural reality that can accelerate value recognition faster than fundamentals alone.

Companies like SMX demonstrate this.

Surviving microcaps demonstrate this.

The next cycle will demonstrate this at scale.

The market rewards companies that survive.

Floats reward shareholders who survive longer than the noise.

And CEOs who understand float architecture — truly understand it — gain a strategic advantage that few talk about but every serious market participant recognizes when they see it.

In the end, the tight float phenomenon is a reminder:

Ownership matters.

Discipline matters.

Structure matters.

Conviction matters.

And when those converge, price follows — often in ways the market is structurally incapable of stopping.